Securities Investment

Securities Investment

BOZE FO has been developing the global asset allocation method since 2013 following the investment philosophy that integrates western classical asset allocation ideas, Chinese characteristics and the company’s strengths. As a pioneer in family office asset management in China, BOZE has gained rich experience in domestic and foreign investment. In the securities market, according to the allocation philosophy of broad categories of asset classes, BOZE uses both top-down strategic planning for long-term and systematic considerations and bottom-up tactic approaches that allow flexibility. At the strategic level, BOZE reviews each asset classes and investment opportunity in different regions from a global perspective to give allocation recommendations based on asset quantity and types. At the tactical level, BOZE chooses appropriate tools and short-term allocation strategies based on market characteristics and valuation.

BOZE made its first investment in securities with its own assets, so BOZE’s security investments bear the traits of the founding family’s prudence and discretion. From a practical buyer’s perspective, BOZE conducts in-depth fundamental analysis and follows the long-term value investing strategy. The company also has a stringent risk control system to minimize risk exposure undertaken by wealthy families and realize stable value increase. With its engagement in the securities market, BOZE endeavors to grow alongside the fast growing, elite companies around the world, especially in China. BOZE expects that healthcare, consumer goods, high-end manufacturing and TMT sectors will be the best prospects in the long term.

BOZE always takes the stabilization and increment of family wealth as the primary goal. BOZE has established a professional manager screening, evaluation, and risk control system with the characteristics of the family office. With the manager ecosystem based on the family office, BOZE has selected excellent managers in China and overseas and achieved absolute returns across cycles.

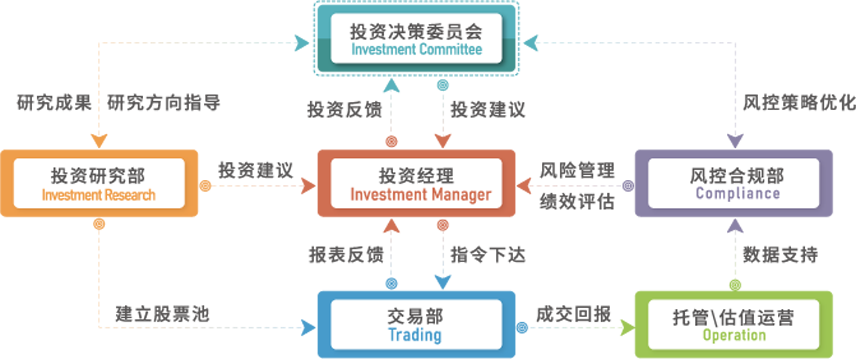

Investing and Reporting System

External Resources System

BOZE maintains long-term collaborative relationships with domestic and overseas renowned private banks, investment banks, fund managers, asset management companies, MFO, senior consultants and advisers. These professional agencies will provide BOZE with product solutions and resources from multiple perspectives. Within the established allocation design framework, BOZE identifies and integrates external superior collaborative resources to select proper products and presents families with a comprehensive solution for main asset allocation. As family business strength continues to grow, BOZE has begun offering special wealth management products, including Special Pharmaceutical Investment, FOF Global Elite Portfolio and FOF Global Selected Portfolio.